Scenius Sync (Issue #83)

Bitcoin Flashes and Fades as ETF Launches but ETH Soars, Gensler Sees ETF Irony In Light of Satoshi’s Vision, Jupiter Finally Sets Date for JUP Airdrop, & Tether Now Owns 2/3 of Stablecoin Supply

Scenius: The intelligence and the intuition of a whole cultural scene. The communal form of the concept of genius.

Welcome to The Scenius Sync.

Our mission with this concise publication is twofold:

Share the essential stories driving the crypto industry and markets.

Highlight innovative applications and mainstream adoption of crypto and blockchain technology.

If you find this newsletter valuable, please subscribe and share The Scenius Sync with your network 💪

Essential News 🗞

This Week in Coins: Bitcoin Flashes and Fades as ETFs Launch—But Ethereum Soars

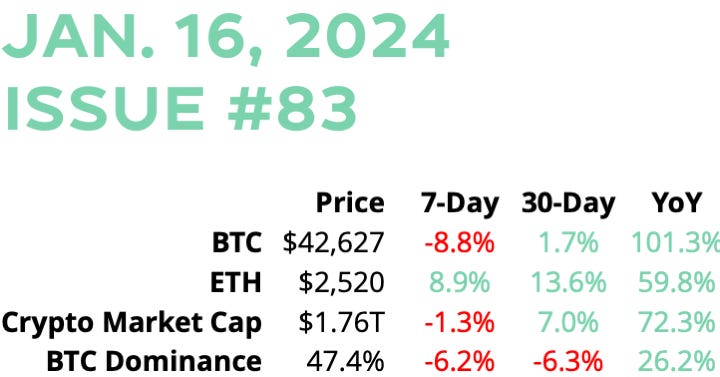

Bitcoin's big week was a rollercoaster. Ethereum closed up. And the rest of the top five were largely flat for the past seven days.

More coverage here: Three unexpected risks from Wall Street's foray into bitcoin & here: Crypto market sentiment turns ‘neutral’ days after spot bitcoin ETF approval, index shows

"There's an irony in the midst of this — Satoshi Nakamoto said this was going to be a decentralized system and finance — this has led to centralization," Gensler said on CNBC. Gensler's comments come days after his agency approved a series of spot bitcoin ETFs, though the chair quickly pointed out that it did not mean the SEC approves or endorses bitcoin. Spot bitcoin ETFs began trading on Thursday and have since cleared $6 billion of cumulative volume.

In Failed Bitfinex Exploit Attempt, Billions in XRP Moved

A feature of the XRP Ledger network was used in an unsuccessful exploit attempt on prominent crypto exchange Bitfinex, chief technology officer Paolo Ardoino confirmed in an X post on Monday. Nearly $15 billion worth of XRP were flagged by on-chain service WhaleAlerts to be moved in an apparent transaction early Monday – amounting to nearly half of the token’s $31 billion market capitalization. But the actual transfer was just for a few cents worth of XRP, and failed as the sender “did not have enough liquidity,” blockchain data from the transaction shows. The motive was to seemingly trick Bitfinex into taking the transfer as real, which could have possibly opened the door to a hack. However, Bitfinex’s systems flagged the transfers as a “partial payment,” an XRP Ledger feature that allows a payment to succeed by reducing the amount received.

Genesis reaches settlement with New York regulator. Will forfeit BitLicense and pay $8 million fine

The New York Department of Financial Services plans to announce later today a settlement with Genesis Global Trading, a subsidiary of the major crypto conglomerate Digital Currency Group. After an investigation found significant failures in Genesis’s anti-money laundering and cybersecurity programs, the trading firm agreed to surrender its BitLicense, cease operations in New York, and pay an $8 million fine.

JPMorgan doesn't see more than 50% chance of spot Ethereum ETF approval by May

"In our opinion, for the SEC to approve spot Ethereum ETFs in May, it would need to classify Ethereum as a commodity (similar to bitcoin) rather than a security," JPMorgan's Nikolaos Panigirtzoglou told The Block. "This is far from given, and I wouldn't put more than a 50% chance to the SEC classifying Ethereum as a commodity before May."

On. the topic of an ETH ETF, Gary Gensler Remains Cagey on Ethereum, Punts on Potential ETF

Innovation & Adoption 💡📈

Tether's market share grew by 21 points in 2023, now captures two-thirds of stablecoin supply

Crypto's most valuable company is only getting bigger. Tether, the company that issues the USDT stablecoin, saw its share of the global stablecoin supply grow from 50% to 71% over the course of 2023, according to data from The Block.

In other stablecoin news, PayPal's stablecoin market cap grows 70% over last month to $290 million

Jupiter Finally Sets a Date for JUP Airdrop, Teases Meme Coin Drop on Solana

Solana-based decentralized finance (DeFi) aggregator Jupiter has officially penciled in a launch date and time for its hotly anticipated token airdrop—and will also use its platform to launch a new meme coin before then. The drop—which is set to deliver one billion freshly minted JUP tokens into the wallets of Solana DeFi users—will commence on January 31 at 10:00 am EST, according to an announcement made Monday by Jupiter’s pseudonymous founder, Meow. Almost a million crypto wallets are eligible to receive funds through the airdrop, according to Jupiter. The platform released a tool last month that allows DeFi users to check how much JUP they stand to receive once the airdrop goes live.

Sotheby's opens bidding for curated Bitcoin Ordinals auction

Called "Natively Digital: An Ordinals Curated Sale," the auction contains 19 pieces — including rare Satoshis, work from the pioneering Bitcoin Ordinals artist Shroomtoshi, generative art and an item connected to the Bitcoin Ordinals brand Taproot Wizards. The auction closes on Jan. 22 at 2:00 p.m. ET. "This sale puts a spotlight on the incredible range of creative diversity found within the Bitcoin ecosystem, as Ordinals have seen explosive growth over the past year," Sotheby's wrote in a release.

Coinbase partners with stablecoin exchange Yellow Card in African expansion

Coinbase has partnered with African stablecoin exchange Yellow Card — a Coinbase portfolio company — to expand access to its products in emerging economies, beginning with 20 countries across the continent. Starting in February, the partnership will provide more than half of Africa's population access to USDC purchases through the Coinbase Wallet app. It will also let app users send the stablecoin without fees via email and popular messaging apps, such as WhatsApp, iMessage and Telegram. Yellow Card users can also buy USDC on Base, a Coinbase-incubated Ethereum layer 2 that offers cheaper transactions.

Crypto’s HashKey Raises $100 Million, Claims Unicorn Status

HashKey Group, operator of one of Hong Kong’s two licensed crypto exchanges, said it raised nearly $100 million in a funding round and is now a so-called unicorn with a valuation exceeding $1 billion. The company said in a statement on Tuesday that existing and new investors contributed the funding but refrained from identifying them. The money will be used to build out a web3 ecosystem as well as licensed products in Hong Kong, the firm said. HashKey added its valuation lies north of $1.2 billion