Scenius Sync (Issue # 189)

VanEck launches first AVAX ETF, Tether launches USAT, Coinbase/Kalshi prediction markets go live in all 50 US states, Fidelity Investments launches FIDD, & Escape Velocity raises $62M for DePIN bet

Scenius: The intelligence and the intuition of a whole cultural scene. The communal form of the concept of genius.

Welcome to The Scenius Sync.

Our mission with this concise publication is twofold:

Share the essential stories driving the crypto industry and markets.

Highlight innovative applications and mainstream adoption of crypto and blockchain technology.

If you find this newsletter valuable, please subscribe and share The Scenius Sync with your network 💪

Essential News 🗞

Avalanche Gets First US ETF As VanEck Debuts AVAX Fund

The first U.S. spot Avalanche (AVAX) exchange traded fund (ETF)—VAVX—from global asset manager and fund issuer VanEck began trading on the Nasdaq on Monday. The fund offers investors exposure to spot AVAX token performance and staking rewards, all while expanding the pool of crypto ETFs available to U.S. investors. “We see Avalanche as one of only a handful of smart contract platforms, alongside Ethereum and Solana, equipped to offer the network throughput (and in Avalanche’s case, customization) that institutions will demand as tokenization accelerates,” VanEck Director of Digital Assets Product Kyle DaCruz told Decrypt.

Similarly, First Avalanche ETF hits US markets as VanEck launches AVAX fund

Tether, the largest company in the digital asset industry, today announces the official launch of USA₮, the federally regulated, dollar-backed stablecoin developed specifically to operate within the United States’ new federal stablecoin framework established under the GENIUS Act. The issuer of USA₮ is Anchorage Digital Bank, N.A., America’s first federally regulated stablecoin issuer. While USD₮ continues to operate globally and leads as the world’s most widely adopted stablecoin, progressing towards GENIUS Act compliance, USA₮ is purpose-built for the U.S. market and its highly digital payment infrastructure, providing institutions with a digital dollar that is issued through a nationally chartered bank.

Clawdbot Chaos: A Forced Rebrand, Crypto Scam and 24-Hour Meltdown

A few days ago, Clawdbot was one of GitHub’s hottest open-source projects, boasting more than 80,000 stars. It’s an impressive piece of engineering that lets you run an AI assistant locally with full system access through messaging apps like WhatsApp, Telegram, and Discord. Today, it’s been forced into a legal rebrand, overrun by crypto scammers, linked to a fake token that briefly hit a $16 million market cap before collapsing, and criticized by researchers who found exposed gateways and accessible credentials. The reckoning started after Anthropic sent founder Peter Steinberger a trademark claim. The AI company—whose Claude models power many Clawdbot installations—decided that “Clawd” looked too much like “Claude.” Fair enough. Trademark law is trademark law.

CertiK eyes IPO at $2 billion valuation as it targets ‘first public web3 cybersecurity’ listing

Binance-backed onchain analytics firm CertiK is planning an initial public offering, according to co-founder Ronghui Gu. “We still do not have a very concrete IPO plan. But this is definitely the goal we are pursuing,” Gu, who is also an associate professor of computer science at Columbia University, told Acumen Media during an interview at Davos this week. CertiK last raised capital at a $2 billion valuation in 2022, in an $88 million Series B3 round co-led by Insight Partners, Tiger Global, and Advent International. Gu noted that Binance was CertiK’s first and is currently its largest financial backer, and it has raised funds from firms like Coinbase and Softbank.

Polymarket Lands Major League Soccer Partnership Deal

Polymarket has secured a multi-year agreement with Major League Soccer to become the league’s exclusive prediction market partner for matches and the Leagues Cup tournament. The partnership will create second-screen fan experiences with real-time data, statistics, and market sentiment around games, the companies said Monday. Polymarket CEO Shayne Coplan said the deal gives soccer fans new ways to engage with matches through data-driven interaction. The agreement includes integrity safeguards such as independent monitoring of trading activity to protect match outcomes from manipulation.

Similarly, Polymarket Signs Multi-Year Partnership Deal With Major League Soccer

Innovation & Adoption 💡📈

Coinbase prediction markets go live in all 50 US states via Kalshi

Coinbase has expanded its prediction markets offering to users across all 50 U.S. states through its partnership with Kalshi, moving beyond an earlier, limited rollout. The nationwide availability follows Coinbase’s initial announcement last month, when the exchange said it had begun rolling out access to prediction markets, allowing users to trade on the outcomes of real-world events such as politics, sports, entertainment, culture, and economic indicators. At the time, Coinbase said all market flow would come from Kalshi at launch — a Commodity Futures Trading Commission–regulated prediction market platform — with plans to support contracts from additional prediction market platforms in the coming months.

See Coinbase’s X announcement here.

Fidelity Investments is launching its first stablecoin, the Fidelity Digital Dollar (FIDD), based on the Ethereum network. FIDD will be backed by reserves of cash, cash equivalents, and short-term U.S. Treasuries managed by Fidelity, in line with the new federal GENIUS Act’s standards for payment stablecoins.

The stablecoin targets use cases such as 24/7 institutional settlement and onchain retail payments, putting Fidelity in direct competition with dominant issuers like Circle’s USDC and Tether’s USDT while laying groundwork for future onchain financial products.

Gemini Launches Zcash Credit Card That Pays ZEC Rewards

Publicly traded crypto exchange Gemini unveiled its latest branded crypto credit card this week, launching a card that highlights the privacy-focused Zcash (ZEC) token. The Gemini Credit Card Zcash Edition follows the firm’s launch of Bitcoin, Solana, and XRP-themed cards that similarly provide crypto rewards with every purchase. “Privacy is normal and a precondition to your freedom and self-sovereignty,” Gemini co-founder Tyler Winklevoss posted on X. According to data provided by the firm, card holders who have opted to receive and hold rewards in ZEC for at least one year saw the value of their holdings appreciate by more than 900%.

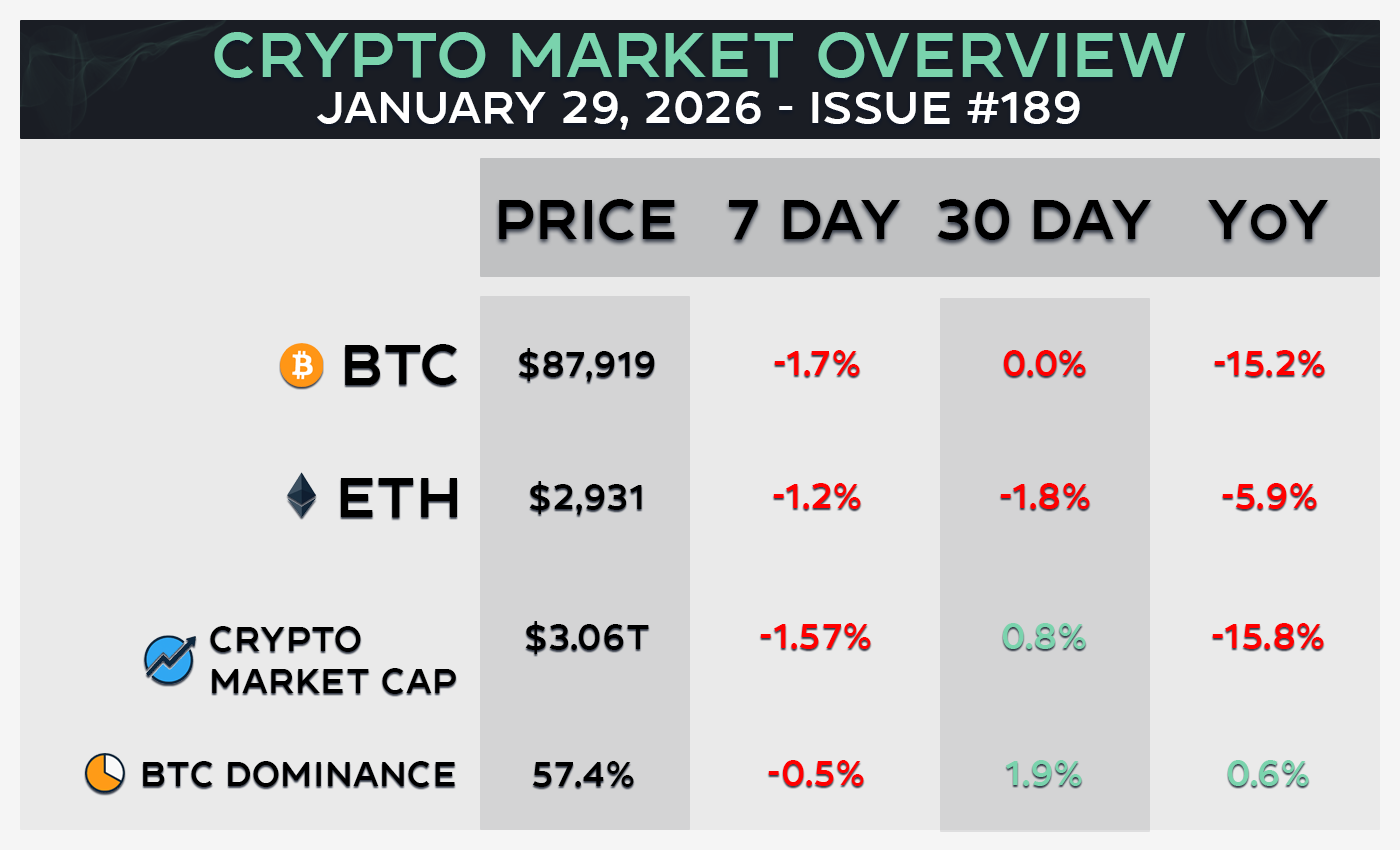

While Bitcoin treads water to start 2026, sentiment for other niches in crypto has soured even more—especially DePIN, or decentralized physical infrastructure. Tokens for the decentralized cellphone service Helium and the decentralized mapping network Hivemapper, for example, are near all-time lows. Still, some investors remain bullish on the concept, including the upstart venture firm Escape Velocity, which has raised $61.74 million for a second fund to back founders in DePIN and crypto more broadly.

Ethereum to launch standard for AI agent economy on mainnet this week

Ethereum announced that ERC-8004, a proposal defining a standard for trustless AI agents on the network, is set to go live on mainnet soon.

The proposal, introduced in August 2025, aims to allow AI agents to interact with different organizations and platforms on Ethereum to enable a decentralized, permissionless economy where agents act as full economic participants. “By enabling discovery and portable reputation, ERC-8004 allows AI agents to interact across organizations ensuring credibility travels everywhere,” Ethereum wrote on social media platform X on Tuesday. “This unlocks a global market where AI services can interoperate without gatekeepers.”