Scenius Insights: Deal Flow Digest February 2024

Special Guest Post from Ben Lakoff, CFA, GP of Bankless Ventures

Scenius: The intelligence and the intuition of a whole cultural scene. The communal form of the concept of genius.

Welcome to Scenius Insights — a Scenius Capital publication platform for crypto and blockchain thought pieces, research, market commentary, and occasional musings.

This issue of Scenius Insights is prepared and contributed by Ben Lakoff, CFA. Ben is a General Partner at Bankless Ventures an early-stage crypto venture fund. Bankless Ventures completed their first close with >$30M in June'23 and focuses exclusively within the crypto/web3 space.

If you would like to contribute your thought piece or research for publication to Scenius Insights, please reach out. And if you find this newsletter valuable, please subscribe and share Scenius Insights with your network 💪

Gm!

Please enjoy the February Deal Flow Digest, a monthly newsletter recapping recent Crypto / web3 funding rounds.

Be sure to check out the Airtable below with ALL the deals, and the recent hackathon/demo day results (in the links).

Flows.

$ Flows and volume. 🤌🤌

Crypto is highly reflexive. Public markets go up and then shortly after, private markets start to heat up.

Dec’23 / Jan’24 private market valuations started inching up to match the public markets pumping… and then suddenly the private markets mispricing was gone.

Private markets right now are bananas. Deals are being bid up to crazy valuations and are closing at record speeds. Seems there is capital to deploy and public market prices have increased the timeline to deploy. Bull Market is mostly priced in. Strap in.

Why are public markets ripping? A large driver is the BTC ETF flows indicating a massive ETF launch success and assumption that an ETH ETF (and possibly more Crypto-focused ETFs) is to come shortly after (perhaps this year). Additionally, it’s been a long bear market and builders have been shipping quite a lot :)

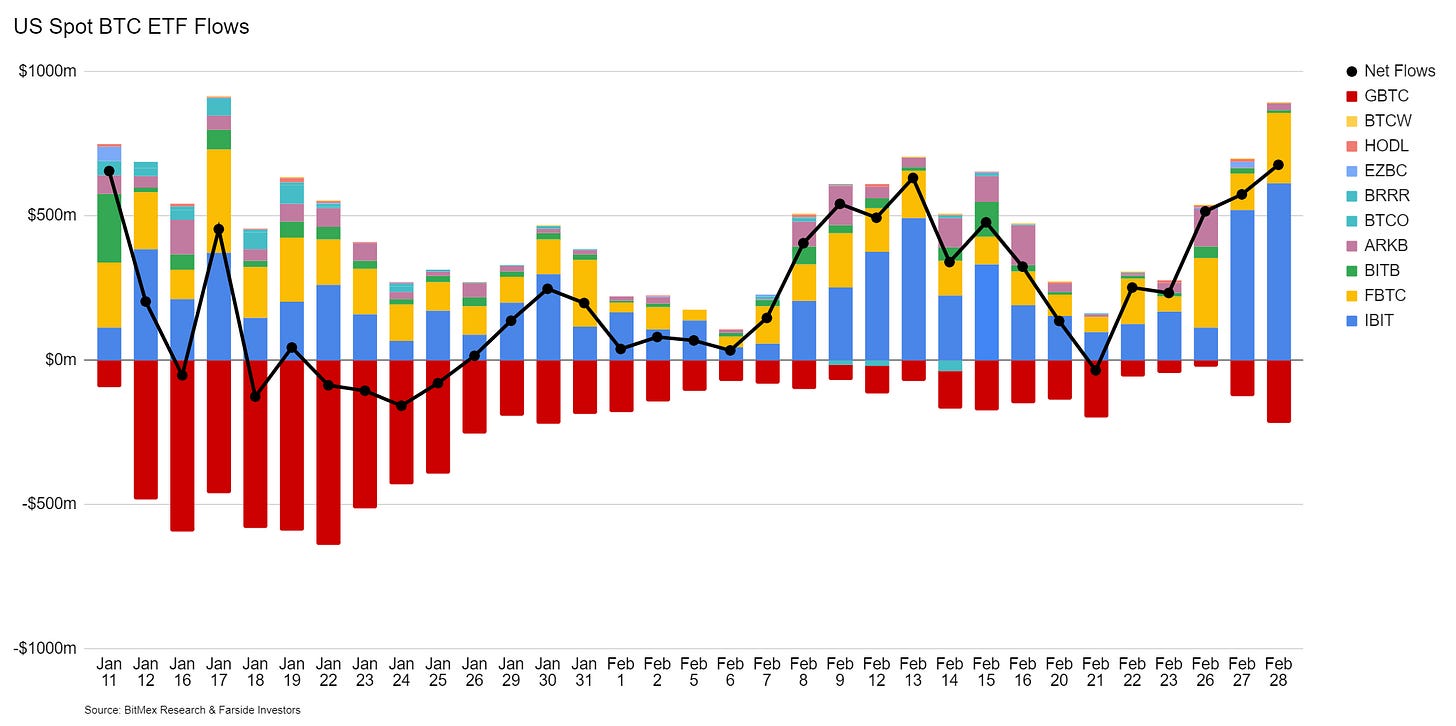

Trading volumes on the BTC ETF have surpassed all expectations and continue to rip:

In the trenches of the crypto markets, we’ve spent 10+ years of waiting on a spot BTC ETF. Now, after about a month of trading for the BTC ETFs, we can see that the buying demand is there and the launch was a massive success.

Initial numbers were dampened by GBTC’s liquidity unlock, but at this point, the net inflows to BTC ETFs have drastically surpassed even the most bullish projections. Easy march to ATH here we come!?

February volumes have heated up, and the institutional sales powerhouse is only warming up to market these ETFs. Apparently, boomers want to own Bitcoin in their brokerage accounts. Check out these inflows (from Farside):

Simply put, every possible metric surrounding the launch of BTC’s long-awaited spot ETFs signals that the market is headed higher and I think the trend here is clear: Higher for longer.

How high? Currently, BTC Market Cap is at $1.2 trillion. What’s next? Digital scarcity has a value, yes, and if you want some comps perhaps you can look at the markets for scarce physical commodities like gold ($8T), real estate ($325T), or art ($1.7T).

Another trend in “Flows” - Stablecoins. More USD coming into the ecosystem = less of a “it’s just PvP with the same crypto people” and more fresh new cash to bid up these assets.

Yes, still down from before, but the chart is in a clear upward trend:

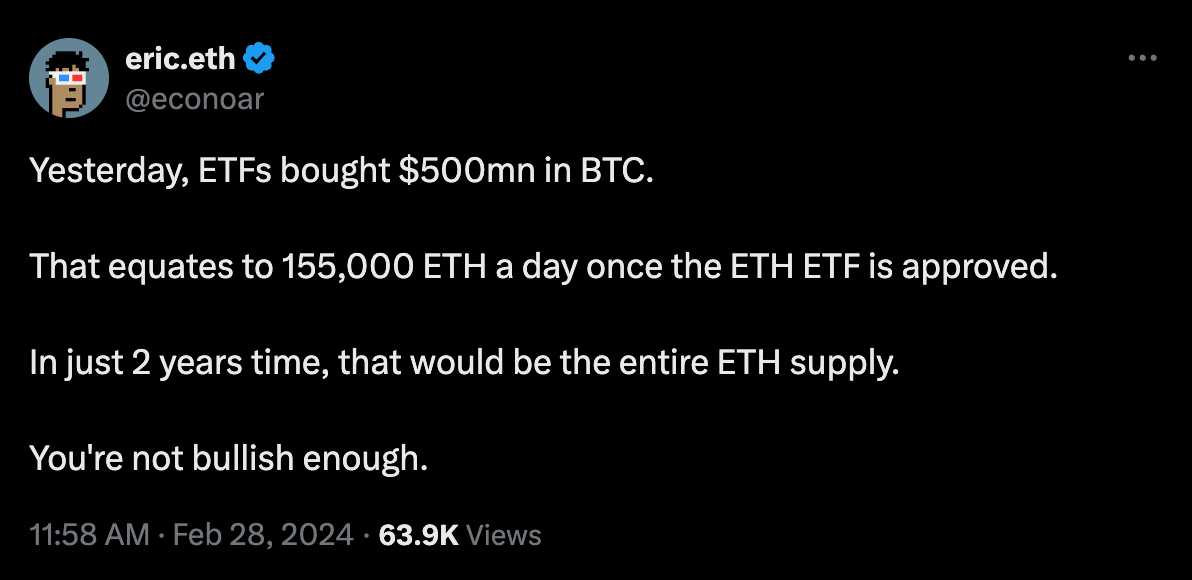

I’m hesitant to guess WHEN the ETH ETF will be approved. I have no idea if it’ll be approved on 23-May-24, but it WILL very likely be approved at some point. The appetite for crypto ETFs is clear, and ETH is the second-largest crypto asset.

And it’s being priced in. Looking at the last month of BTC ETF demand, what do you think would happen with ETH whenever it’s approved? Number go up.

Here’s some bull hopium:

You’re not bullish enough on ETH?

The end result is that the obvious answer is that you start accumulating ETH and doing everything in your power to ensure that spot Ethereum ETFs are (potentially) approved on May 23rd.

To add fuel to the crypto rally, in a perfectly-timed / market-shocking move, a governance proposal from the Uniswap Foundation appeared Friday morning titled, “Activate Uniswap Protocol Governance”. More specifically, the proposal which will open for UNI holder votes on March 1st, proposes to “upgrade the protocol such that its fee mechanism rewards UNI token holders that have delegated and staked their tokens.”

There has been ENDLESS speculation on this exact proposal: to share fee revenue with $UNI token holders, delegators, and stakers. However, with this proposal it comes directly from the Uniswap Foundation. Perhaps they feel better about regulatory uncertainty?

Uniswap Labs, the entity behind Uniswap, has previously blacklisted tokens & addresses, created decentralized alternatives to their front end, said they may share wallet addresses and user information with third parties if litigated or subpoenaed and have shot down any comment, discussion, or potential proposal on the “fee switch” for holders as it’s been considered a nonstarter mostly due to US regulations.

But now, it’s different?

Certainly feels so. $UNI Token quickly repriced from $7 >$10, giving the UNI token a $10B FDV.

Does this mean the DeFi Governance tokens can have value? Added pressure on the US regulatory bodies to give some clarity in this area? One to monitor an important development within the crypto ecosystem.

Crypto is cool again? Higher for longer? Certainly feels that way with these flows. Public markets ripping, new tokens launching, private markets heating up…. It’s going to be a fun year. Stay patient out there in the private markets and buckle up.

Image: Milk Road, original source: Bitwise

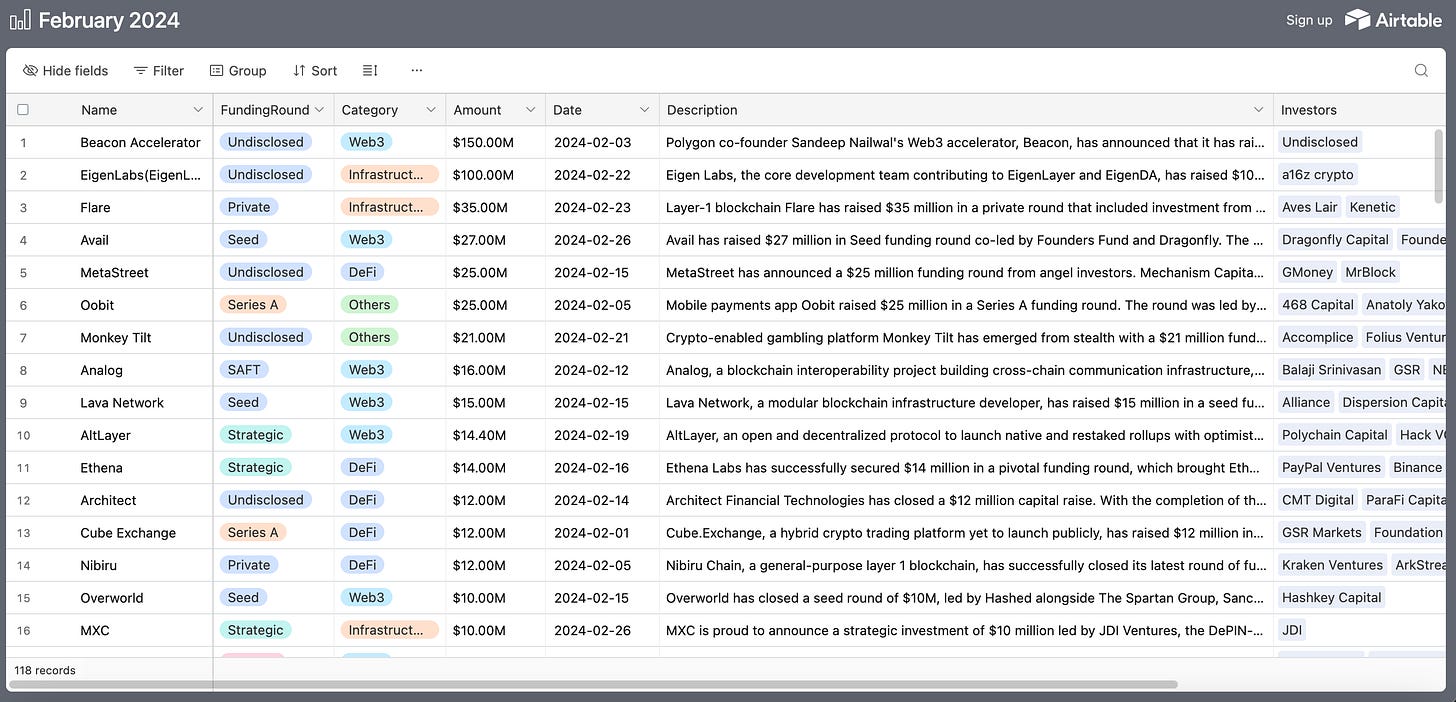

Top Nine Crypto Funding Rounds

EigenLabs (Eigen Layer) | $100M | 2/22/2024

Eigen Labs, the developer behind EigenLayer, the crypto restaking project atop Ethereum that is shaking up the decentralized finance landscape even though it's not yet live, raised $100 million from venture capital investor a16z crypto.

Flare | $35M | Private Round | 2/23/2024

Layer-1 blockchain Flare has raised $35 million in a private round that included investment from Kenetic, Aves Lair, and others. Dubbed a layer-1 network for data, Flare supports the creation of smart contract protocols and focuses on pricing oracles, which relay asset prices to and from various decentralized finance (DeFi) applications.

Avail | $27M | Seed Round | 2/26/2024

Avail has raised $27 million in a Seed funding round co-led by Founders Fund and Dragonfly. The new funding in this round will be used to develop three of core products: its data availability solution (DA), Nexus and Fusion, collectively marketed as the "Trinity."

Meta Street | $25M | 2/15/2024

MetaStreet has announced a $25 million funding round from angel investors. Mechanism Capital's Andrew Kang, GMoney, MrBlock, DCF GOD, Dingaling, Sisyphus, Spencer, FreeLunchCapital, Jae Chung, and GoodAlexander were among those who joined the round.

Oobit | Series A | $25M | 2/05/2024

Crypto payments app Oobit raised $25 million in a Series A funding round. The round was led by the investment arm of Tether, CMCC Global's Titan Fund, 468 Capital and Solana co-founder Anatoly Yakovenko.

Monkey Tilt | $21M | 2/21/2024

Crypto-enabled gambling platform Monkey Tilt has emerged from stealth with a $21 million funding round from Polychain Capital, Hack VC, PokerGO, Accomplice, Paper Ventures, and Folius Ventures among others.

Analog | SAFT | $16M | 2/12/2024

Analog, a blockchain interoperability project building cross-chain communication infrastructure, has raised $16 million in a seed and strategic funding round.

Lava Network | Seed Round | $15M | 2/15/2024

Lava Network, a modular blockchain infrastructure developer, has raised $15 million in a seed funding round ahead of its mainnet launch. Jump Capital, Hashkey Capital and Tribe Capital co-led the round, with North Island Ventures, Dispersion Capital, Alliance DAO, Node Capital, Finality Capital Partners, and others participating. Unidentified executives from Celestia, Cosmos, StarkWare, Filecoin and other blockchain ecosystems also participated in the round.

AltLayer | Strategic | $14.40M | 2/19/2024

AltLayer, an open and decentralized protocol to launch native and restaked rollups with optimistic and ZK stacks, has raised $14.4 million in a strategic fundraising round co-led by Polychain Capital and Hack VC.

Click to see all of February’s funding rounds here:

February Crypto VC Fund fundraise Announcements

15-Feb-2024: RW3 Ventures raises $60 million crypto VC fund with backing from Mubadala and Raptor Group, the family office of billionaire Jim Pallotta, as well as significant support from Mubadala, one of the sovereign wealth funds of Abu Dhabi. In an interview with Fortune, RW3 founder and managing partner Pete Najarian said that the firm's name-brand backers and commitment to real-world blockchain use cases like music and health care will help it ride an anticipated bull market, despite the fund's relatively small size when compared with the leviathans of the last cycle.

03-Feb-2024: Polygon co-founder Sandeep Nailwal's Web3 accelerator, Beacon, has announced that it has raised over $150 million in funds during its first year of operation. Currently, applications for the S24 group are officially open, with the deadline set for March 18, 2024.

Hackathons

Ongoing

ETH Denver February 23 - March 3

Over $1M Available in prizes.

Upcoming

ETH Global London March 15 - 17

$275k Available in prizes.

ETH Vietnam March 13 - 17

ETH Oxford March 8 - 11

$80k Available in prizes.

Bonkathon End of Q1 - 2024

$300k Available in prizes.

Recently Completed (results in links)

Circuit Breaker February 2 - 21

ETH Cinco De Mayo February 2 - 4

Blast Big Bang February 16 - 20

Demo Days

Upcoming

2024 Blockchain Conference at Harvard April 13 - 14

Recently Completed

Brunt (XION) Demo Day February 27

About Ben Lakoff, CFA and Bankless Ventures

Ben Lakoff, CFA (https://twitter.com/benlakoff) is a General Partner at Bankless Ventures (link: https://www.bankless.com/why-were-launching-bankless-ventures) an early-stage crypto venture fund. Bankless Ventures completed their first close with >$30M in June'23 and focuses exclusively within the crypto/web3 space.

Bankless Ventures is a $40M early-stage Web3 Venture fund launched in 2023 to empower pioneers to explore the frontier of Web3.

To learn more, visit their website at: https://www.bankless.ventures/

DISCLAIMER

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

Scenius Capital Management LLC, its affiliates or Funds are not providing any general advice or personal advice regarding any potential investment in any financial products. This letter is an informational document and does not constitute an investment recommendation. Information in this letter may include data and opinions derived from third-party sources. Scenius Capital Management LLC does not accept liability for the accuracy or completeness of any such information or opinions which can be subject to change without notice. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed.