Scenius Insights: Deal Flow Digest November 2023

Special Guest Post from Ben Lakoff, CFA, GP of Bankless Ventures

Scenius: The intelligence and the intuition of a whole cultural scene. The communal form of the concept of genius.

Welcome to Scenius Insights — a Scenius Capital publication platform for crypto and blockchain thought pieces, research, market commentary, and occasional musings.

This issue of Scenius Insights is prepared and contributed by Ben Lakoff, CFA. Ben is a General Partner at Bankless Ventures an early-stage crypto venture fund. Bankless Ventures completed their first close with >$30M in June'23 and focuses exclusively within the crypto/web3 space.

If you would like to contribute your thought piece or research for publication to Scenius Insights, please reach out. And if you find this newsletter valuable, please subscribe and share Scenius Insights with your network 💪

This Scenius Substack was brought to you by DeFi Armor. All institutional on-chain traders and organizations have a major vulnerability that they are unaware of. DeFi Armor’s simple to implement co-signer solution removes a clear risk vector, giving traders and organizations peace of mind. Protect against theft and learn about DeFi Armor’s solution by clicking the link below.

Hello!

Please enjoy the November Deal Flow Digest, a monthly newsletter recapping recent Crypto / web3 funding rounds.

Be sure to check out the Airtable below with ALL the deals, and the recent hackathon/demo day results (in the links).

On Allocation in VC

“I think a life properly lived is just learn, learn, learn all the time." — Charlie Munger (RIP)

Portfolio construction is a hot topic for VC funds and LP investors.

Before investing, most LPs will want to see a fund model and ask: “What is your portfolio construction strategy?”

Thinking about portfolio construction makes a lot of sense. But overly stressing about a perfect model, and tweaking the variables repeatedly has a diminishing return. Search the interwebs and there is A LOT of data, “best practices”, and strong thoughts and opinions on portfolio construction.

There are some VERY established successful funds that say one thing (e.g. concentrate, don’t follow on) and then you have others saying the complete opposite (e.g. diversify).

Within crypto, this is exaggerated. Liquidity can come more quickly than traditional VC via tokens. The ability to recycle quickly within a fund life brings its own challenges.

Moonfire, a London-based VC, released its portfolio simulator earlier this year. As someone who built multiple models from scratch when raising, I appreciate the simplicity of this model.

They ran 972 billion venture portfolio simulations to determine the optimal portfolio construction for a VC fund….. The takeaway: “It’s an art.”

Inconclusive. They added: “There are two main camps: 1) a small, concentrated portfolio, betting on the best companies you can find, or 2) as large a portfolio as possible, acting like a sort of index of the market. And there are plenty of successful examples from both ends of the spectrum.”

So both work. Great.

Zooming out, portfolio performance is driven by five variables: 1) Decision quality 2) Portfolio size 3) Ticket sizing 4) Following on (Yes / No, how much) & 5) Upper bound on ROI (of a single investment).

Yes, you can model these things.

But, these are variables.

Ultimately, to have a well-performing fund, VCs need at least one “outlier” (unicorn). Hitting an outlier?

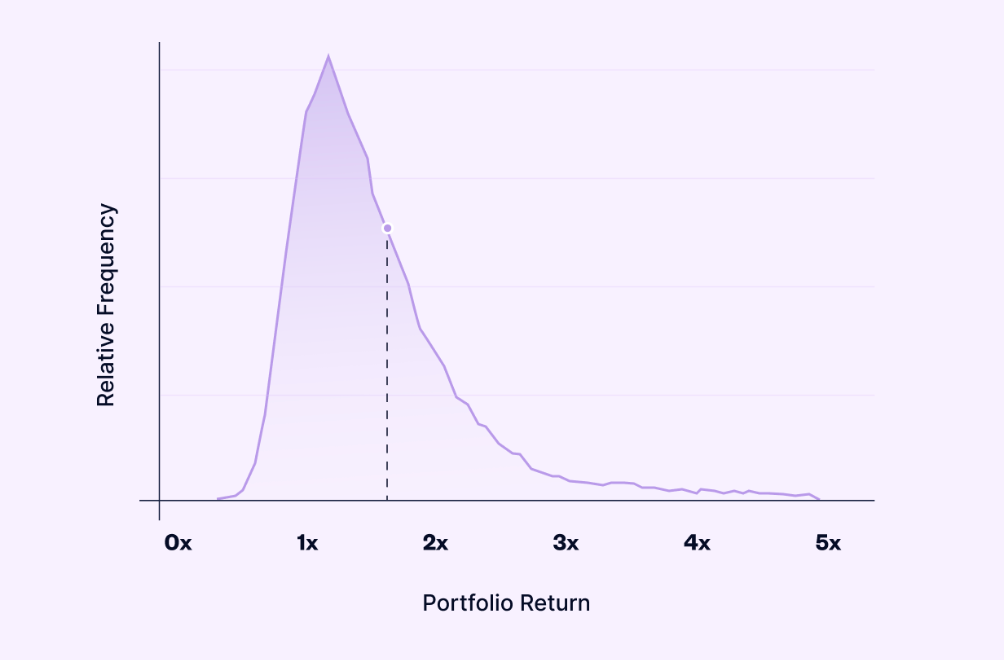

Power laws. Power laws rule VC (see my post from September)

What do power laws look like in venture?

Either way, Venture is an outlier business in an extreme way. Picking a portfolio construction with many investments or very concentrated - they both work. If you have many investments in your portfolio, there is a limit on bandwidth and the number of boards you can reasonably serve. Ultimately, a small number of investments drive the majority of the returns - regardless of your fund strategy.

Even the best firms have many more misses than hits. If a VC has an outlier in a fund, fund returns are likely to do well, and hopefully better than the 3x+ net DPI benchmark. If funds don’t have any outliers? Well, they’ll struggle to hit this milestone and survive.

Top Six Crypto Funding Rounds

Phoenix Group | $370M | IPO | 11/21/2023

Abu Dhabi’s Phoenix Group, a Bitcoin mining service provider, has completed an initial public offering (IPO) that sold 907 million shares, raising approximately 1.3 billion UAE Dirhams, or $370 million. Phoenix Group’s operations span hosting and mining services across the U.S., Canada, Europe, and the Middle East. According to its website, the firm has a 725MW global mining operation that cements its position as a leader in the space. Additionally, it manages an Abu Dhabi-regulated crypto investment platform, M2.

Wormhole | $225M | 11/29/2023

Wormhole, a developer platform that allows different blockchain networks to communicate with each other, has raised $225 million at a $2.5 valuation in a funding round reminiscent of the peak of the last crypto bull run. The funding round included a contribution from Wormhole's former overseers, Jump Trading, with Brevan Howard, Coinbase Ventures and Multicoin Capital among the backers.

Blockchain.com | $110M | Series E | 11/14/2023

Crypto exchange and wallet provider Blockchain.com has closed a $110 million raise, valuing the company at less than half of its previous $14 billion, according to a Bloomberg report. The Series E was led by U.K.-based Kingsway Capital with participation from Lakestar, Lightspeed Venture Partners, and Coinbase Ventures.

Fnality | $95M | Series B | 11/14/2023

Fnality, a fintech firm building tokenized versions of major currencies collateralized by cash held at central banks, has raised $95 million (£77.7m) in Series B funding led by Goldman Sachs and BNP Paribas. DTCC, Euroclear, Nomura and WisdomTree participated in the round, which also saw further commitment from a number of banks that backed Fnality’s $63m fundraise back in 2019: Banco Santander, BNY Mellon, Barclays, CIBC, Commerzbank, ING, Lloyds Banking Group, Nasdaq Ventures, State Street, Sumitomo Mitsui Banking Corporation, and UBS.

BC Group | $91M | Strategic | 11/14/2023

BC Technology Group announced a HK$710 million Hong Kong Dollars Strategic Investment from BGX. This strategic subscription of new shares under a specific mandate, when approved by shareholders, will mark a pivotal moment in the journey of BC Technology Group and its wholly-owned subsidiary OSL, signaling a new era of growth and innovation in the digital asset space.

Bitfarms | $44M | 11/24/2023

Canadian bitcoin mining firm Bitfarms has raised C$60 million, or about $44 million, in a private placement. The publicly traded mining operation said in an announcement on Friday that it expects to close the raise on Nov. 28 by issuing 44 million common shares to certain institutional investors in the U.S. The placement also comes with warrants to buy additional up to 22 million shares at an exercise price of $1.17 with an exercise period of three years.

Click to see all of November’s funding rounds here:

November Crypto VC Fund fundraise Announcements

9-Nov-23: Lightspeed Faction, a crypto-focused venture capital firm that was launched last year in a joint venture with Lightspeed Venture Partners, launched its inaugural fund worth $285 million. Lightspeed Faction was launched in July 2022, and the fund had its first close at that time and the final close in July of this year. Faction will primarily invest in early-stage crypto and blockchain startups, supporting their seed and Series A funding rounds, the firm said Thursday. It is open to investing across crypto verticals, with a focus on those using blockchain technology to deliver real utility to users and businesses.

Outside of crypto…. Khosla Ventures raised a $3 BILLION, yes Billion, fund to invest in startups. Khosla Ventures is “hoping to back more deep-tech companies tackling problems like healthcare and climate change.”

Hackathons

Ongoing

Web3 Global Hackathon 2023 AW September 30 - December 9

$78,000 Available in prizes.

Upcoming

ETH India December 8 - 10

$230,000 Available in prizes.

Taipei Blockchain Week December 11 - 13

$47,000 + ($1.5M NTD) Available in prizes.

Recently Completed (results in links)

ETH Lisbon November 3 - 5

Nearcon (Lisbon) November 7 - 10

ETH Global Istanbul November 17 - 19

Barcelona Game Jam November 25 - 26

Want more for 2024? Check out the (s/o Nathan) 2024 Ethereum Events Calendar. Many of these events have hackathons around the event dates!

Demo Days

Upcoming

Demo Day - India Blockchain Week December 4 - 10

Light Cycle - Web3Port Demo Day December 1

Recently Completed (results in links)

OPL x SEI Incubator Demo Day November 6

Conviction Investor Demo Day November 9

ETH AbuDhabi Demo Day November 27 - 29

About Ben Lakoff, CFA and Bankless Ventures

Ben Lakoff, CFA (https://twitter.com/benlakoff) is a General Partner at Bankless Ventures (link: https://www.bankless.com/why-were-launching-bankless-ventures) an early-stage crypto venture fund. Bankless Ventures completed their first close with >$30M in June'23 and focuses exclusively within the crypto/web3 space.

Bankless Ventures is a $40M early-stage Web3 Venture fund launched in 2023 to empower pioneers to explore the frontier of Web3.

To learn more, visit their website at: https://www.bankless.ventures/

DISCLAIMER

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

Scenius Capital Management LLC, its affiliates or Funds are not providing any general advice or personal advice regarding any potential investment in any financial products. This letter is an informational document and does not constitute an investment recommendation. Information in this letter may include data and opinions derived from third-party sources. Scenius Capital Management LLC does not accept liability for the accuracy or completeness of any such information or opinions which can be subject to change without notice. The information set forth herein does not purport to be complete and no obligation to update or otherwise revise such information is being assumed.